What Is Total Program Costing? And Why Should I Care?

The band festival was just concluding. The last band had marched out of the performance area and was enjoying hamburgers before boarding the bus for the drive to their hotel. The full stands were emptying out, and the event committee members were ecstatic, patting each other on the back and giving each other high fives. They had nailed the event! Everything went off like clockwork, and all three shows were sellouts or near sellouts. Fabulous, right? Well actually, although no one knew it at the time, the event had just lost the host organization $75,000. How could this be?

The problem was that the organization (at the time) did not use total program costing and, as a result, they really did not understand and appreciate all the costs that went into their event. The organization in question was structured into a series of committees. Some of the committees were event committees and some were support committees which provided logistical support for multiple event committees. The organization’s accounting system, like many smaller organization accounting systems — both in the for-profit and nonprofit arenas — was good only at tracking specific line items within the budget. So at the end of the year, the system would tell the committee chair how well he or she had done against the total assigned budget and how much in total had been spent in the aggregate on particular line items, but it did not break down the line item costs on an event-by-event basis. Moreover, it had no way of combining the expenses of several different committees into one event budget.

The result in this real life case was that the event committee and the organization’s leadership were oblivious to the costs absorbed by the support committee, and the accounting system was unable to assemble all of the costs associated with the band festival. When the organization finally developed the capability to do total program costing, the leadership was stunned to find that this event and several other events which had been considered cash cows were actually losing money.

Just because your organization doesn’t do committee based budgeting doesn’t mean you don’t need to watch out for the problems related to total program cost. The typical accounting system used by nonprofits consists of a chart of accounts (line items). As expenses are incurred, they are coded against these line items. The system tracks these line item expenses over time, and at the end of the year you get the total expenses in that area. But unless you recognize the need for total program costing, you may not have expenses coded against specific events or programs. Let’s take a look at another case, this time hypothetical, where this could adversely affect your organization.

Let’s say your organization runs an annual gala fund raising event. At the end of the event the organizing committee presents the executive director with a bill for the event that includes facility rental, food, drinks, and decorations. The event looks like a huge success on paper. But let’s take a closer look.

How about the money in the public relations budget that is used to advertise the event? How about the money in the technology budget that was used to send out electronic invitations, take sign ups and send out day of event information? How about the special insurance in the risk management budget needed for that particular event? How about the permit fees, security costs and health inspector costs that are hidden in the payment made annually to the city? How about the money in the legal services budget for the review of contracts related to the event? How about the salary of the staff member who spends more than half of their working hours each year on the event (and don’t forget to add in the 25% of his or her salary that pays for taxes and benefits). I could go on and on, but hopefully the point is made. The total program costs of an event are not always just the obvious ones that the organizing committee deals with. There are often hidden event costs contained in other line items in the accounting system. To really understand what a program or event costs, you have to do total program costing. And it is this total cost that must be compared to the revenues from the event to determine how much the event is benefitting the organization or whether you really have a money loser on your hands that no one really knows about.

OK, you say, I’m convinced, but I still have the same accounting system that was described earlier. How can I make that work for me? The simple answer is you need to determine just what the capabilities of your system are, and you need to build a new chart of accounts that allows you to not only code line item costs, but also allows you to track that same line item expense as a component of an event. In essence, you need a new accounting code that allows the same expense to be tracked in different ways. If your system won’t allow you do this this, you need to find a new accounting system.

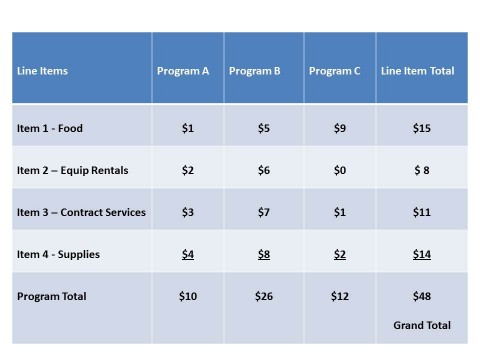

The chart below illustrates what I am trying to describe. The typical accounting system wants to horizontally track line items like food, equipment rentals, etc., over time as shown below. The system needs to be reconfigured with new accounting codes so that each expense entry will not only show up in the horizontal rows, but will also show up in a vertical program column as well.

Figure 1. Total Program Costs ($000)

Making this change will cost some money and time for your accounting department, and it will involve some training on the part of your event and budget managers to make sure the new codes get implemented, but trust me, the results will be worth it!

As a manager, you may have to make tradeoffs based on program worth, and you may even need to eliminate programs that are less beneficial than others. Until you have the tools provided by total program costing, you are making decisions without all the relevant facts. Given the choice, you would never do that if you could avoid it. Don’t let the existing shortcomings in your accounting system blind you to the data you need for rationale decision making. Get the system to work for you, not against you.

Share This